tn franchise and excise tax return

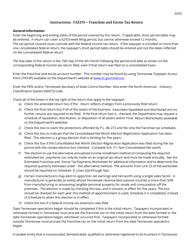

We last updated the Franchise and Excise Tax Return Kit in February 2022 so this is the latest version of Form FAE-170 fully updated for tax year 2021. A SMLLC is required to file a franchise excise tax return when 1 it is not disregarded for federal income tax purposes or 2 when it is disregarded for federal income tax purposes.

Llc Tennessee How To Start An Llc In Tennessee Truic

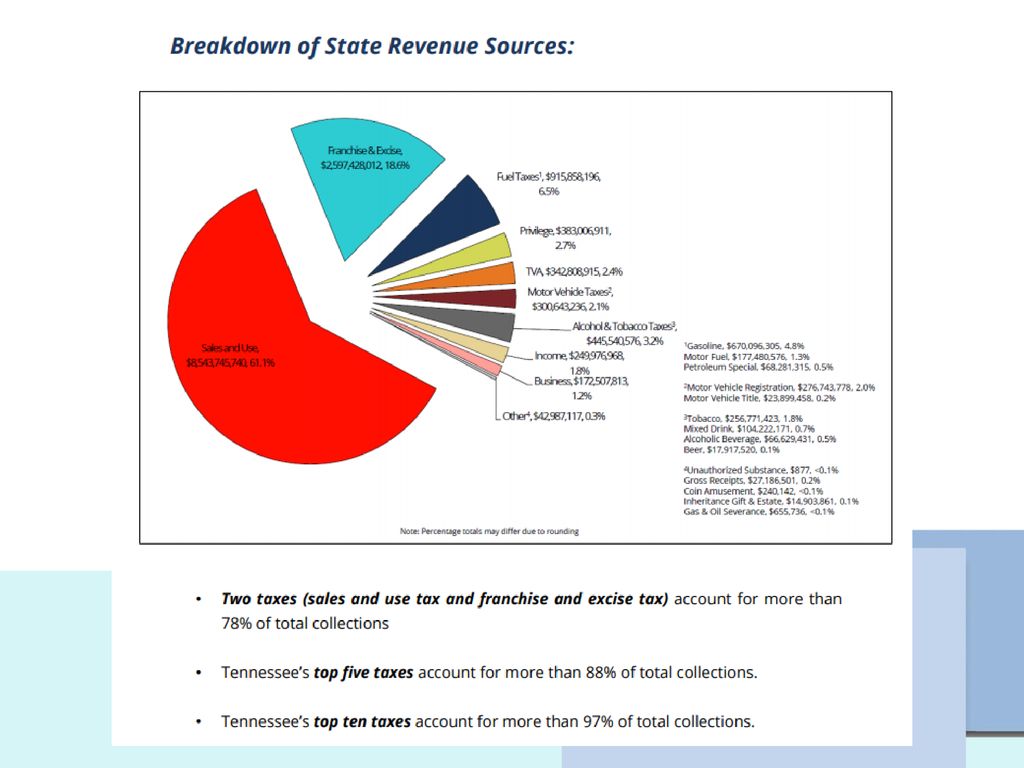

All entities doing business in Tennessee and having a substantial nexus in.

. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. The minimum tax is 100. The Tennessee Franchise and Excise tax has two levels.

The following entity types may be required to file the franchise and excise tax return. We last updated the Franchise and Excise Tax Return Kit in February 2022 so this is the latest version of Form FAE-170 fully updated for tax year 2021. Wwwtngovrevenue under Tax Resources.

Corporate Income or Excise Tax. Schedule 170NC 170SF Consolidated Net Worth. What is TN excise tax.

You can download or print current or. Penalty on estimated franchise and excise tax payments is calculated at a rate of 2 per month or portion thereof that an estimated. Excise tax 65 of.

The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise. TNTAP is Tennessees free one-stop site for filing your taxes managing your account and viewing correspondence. FT-2 - Franchise Tax Computation on a Final Return.

The franchise tax on a final return is computed using either the book value of assets or net worth immediately preceding. 025 per 100 based on either the fixed asset or equity of the. The minimum tax is 100.

Franchise tax 025 of the greater of net worth or real and tangible property in Tennessee. 65 excise tax on the net earnings of the entity and. You can download or print current or.

FE-9 - Extension for Filing the Franchise and Excise Tax Return. Form IE - Intangible Expense Disclosure. Franchise and Excise Tax Return Tax Year Beginning Account Number Tax Year Ending NAICS Legal Name Mailing Address City State ZIP Code a Amended return b Final return c Public.

Form FAE170 Franchise and Excise Tax Return includes Schedules A-H J K M N-P R-V. Franchise tax 25 cents per 100 or major fraction thereof of the greater of either net worth or real and tangible property in Tennessee. FE-15 - Inactive Business Final Return and Closing Your Account.

To receive a six month extension a taxpayer must have paid on or before the original due date an amount. This blog series will cover certain aspects of Tennessees Franchise and Excise tax and give particular focus to the more common exemptions available under the taxing statute.

Tennessee Cpa Journal May June 2015

Nashville Attorneys Esports Intellectual Property Business Entertainment H G Llp

How To Form An Llc In Tennessee Llc Filing Tn Swyft Filings

Franchise Excise Tax Tn Investco Entities Youtube

Tennessee State Tax Updates Withum

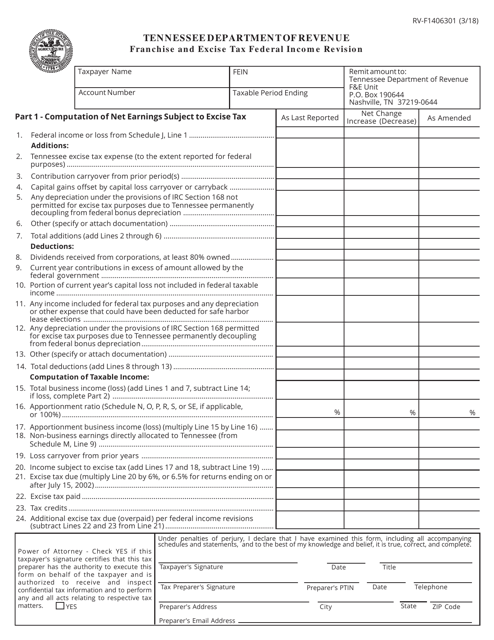

Fillable Online State Tn Tennessee Tax Franchise Excise Federal Income Revision Form Fax Email Print Pdffiller

Free Tennessee Tax Power Of Attorney Form Rv F0103801 Pdf Eforms

Fae 173 2012 Form Fill Out Sign Online Dochub

Covid 19 Tn Department Of Revenue Extends Certain Tax Deadlines Ucbj Upper Cumberland Business Journal

Fae 172 Form Fill Out And Sign Printable Pdf Template Signnow

Tennessee Cpa Journal May June 2015

More Help Available For Tennessee Business Owners

Fillable Online Tn Tennessee Application Exemption Franchise Excise Taxes Form Fax Email Print Pdffiller

Form Rv F1406301 Download Printable Pdf Or Fill Online Franchise And Excise Tax Federal Income Revision Tennessee Templateroller

What Federal Tax Reform Means For Tennessee

Download Instructions For Form Fae170 Rv R0011001 Franchise And Excise Tax Return Pdf 2020 Templateroller